To Larry's point:

Average credit card debt in America = $16,000

SourceAverage Income in America = $90,000

Median Income in America = $60,000 (without those pesky 10%ers dragging the Average up.

If we assume that most 10%ers don't have credit card debt which they are unable to pay off every month, then it's reasonable to assume that the average American is carrying a 16% CCdebt/cashflow load. Of course, this doesn't include the debt for Auto, Home, etc.....

"The median household income hit $61,372 in 2017, according to the U.S. Census Bureau. That’s almost $20,000 more than it was in 2000. But the typical American household now carries an average debt of $137,063. The median debt was only $50,971 in 2000."

Source (These folks mix "median" and "average" up quite a lot.)

In any event, if we do the math based on mean in both cases the average (mean) household is carrying a 56% Debt/Cashflow ration. That is an absurd level of debt for anyone to carry.

Just as companies with high levels of debt and small amounts of cash have trouble in any economic downturn, let alone the worst downturn in over 90 years, individuals who are this indebted will be crushed by the downturn.

So, how about assets. Income isn't everything especially if you're retired.

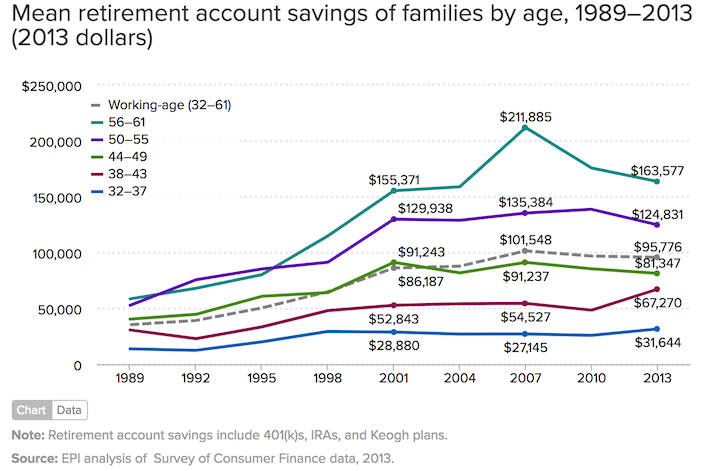

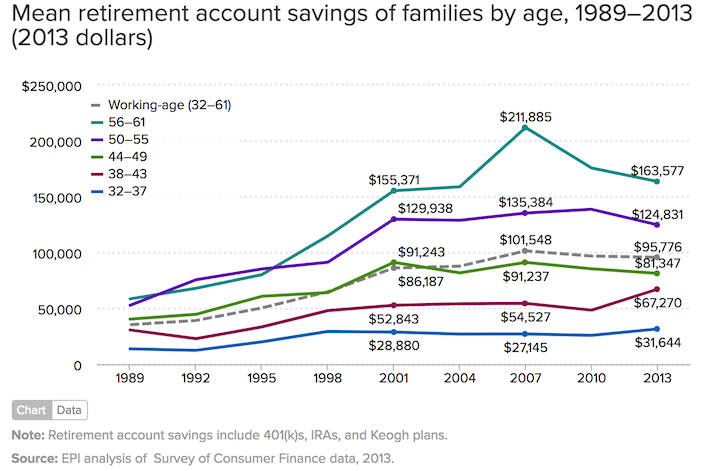

If we include retirement funds it's still terrible. Two reasons, first almost all the retirement funds are invested and if they were at all aggressive they are down about 20% this year to date. In the graph below, you can see what the average is and what it is broken out by age group. Second, savings accounts outside of retirement funds are a paltry average of $40,000.

What this means is that the debt/asset ratio is a shocking 100%. Despite decades of trying to get people to build up assets for retirement or bad times, Americans (on average) have every dollar of savings offset by a dollar of debt. It is much much worse for the median family with more debt and fewer assets. A decade of "good times" have lulled folks into believing that their home prices never go down (Zillow says ours has dropped 28% in the last year), that their 401k is safe (despite being invested in the market), and that they'll be just fine.

Now, they find that they are utterly unprepared for any downturn, let alone one of this size, depth, and duration. Bankrupcies are going to go through the roof, primarily because folks have been living paycheck to paycheck for a long time and have no safety net.