kdh wrote:BeauV wrote:I could not AGREE MORE! At the root of the stupidity is the US Congress trying to do Social Engineering by altering people's behavour with the tax code.

I'm curious about your thoughts, Beau.

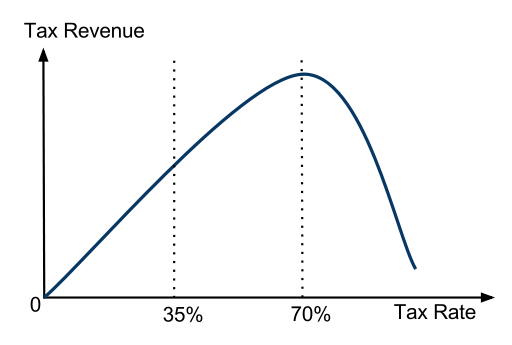

I've always thought a good progressive system is about the right incentives--basically maximizing economic output and the amount of taxes collected, which means that government assistance at the low end doesn't discourage people from working and at the high income end onerous taxes don't, for example, provide a disincentive for people like you to work (and pay taxes) and provide jobs rather than retire.

Keith, my opinions have evolved over time, and therefore they could be quite wrong.

A couple of assertions are in order, by way of things that I feel we have to accept as "true" despite many folks generally believing them to be either false or irrelevant.

1) The social and economic behavour of millions of people isn't simple by any stretch and is not even partially understood by anyone, which means the reasons that our social behavour acts in certain ways is not predictable.

2) Expecting to predicting the effects of an exogenous force on a poorly understood system is foolish, one will be wrong most of the time.

3) If one's goal is to cause a certain effect in a complex and poorly understood system, then one needs to experiment and correct for the numerous errors that one will undoubtedly make. There is nearly zero chance of getting any desired effect on the first attempt.

The above are true of every complex system I know of, from servo control systems within disk drives to the astounding complexity of the human endocrine system. The former we can actually write a formula for and show empirically that it is accurate; whereas, the later we are hopelessly far away from any form of formulaic expression of how the system works. Simply put, when it comes to the social and economic behavour of our population in the US (setting aside the rest of the world for now) we are event further from actually understanding the "system" than we are with our endocrine system. Thus, my first conclusions: We have no idea what we're doing.

Second, in any complex system in which one accepts that they don't know what they're doing one needs to try and determine the causal relationships empirically. OK, how can this be approached in a rational manner with our societal and economic behavour? Well, we can try something with some predefined set of expectations, see if it works and then fix it if it doesn't. But, our US Congress doesn't ever appear to do that, with some notable exceptions. One clear exception is Prohibition, which was clearly a disaster and was repealed. But the rest, indeed most of the use of economic "encouragement" to improve things has been run entirely open loop. There is no correction in the system. I would argue there can't be. The Congress members who vote to try something, effectively an intentional perturbation of our complex and deeply misunderstood system, are almost never in power at the time the effects of such a perturbation will start to manifest themselves. Thus, my second conclusion: We have a system that is almost designed not to correct for obvious errors.

Finally, when faced with a complex and deeply misunderstood system which one is trying to control or alter, albeit for perfectly good reasons like the ones you've stated above, at the very least a rational actor would start with simple well understood actions that could potentially have somewhat predictable results. But that's not anything like what our Congress actually does. For example, given the complexity of our tax code, who can possibly claim with any credibility that a specific change has a specific result? I have heaps of friends, as I'm sure you also do, who will say things like: "High personal and corporate income taxes are driving away jobs." while also accepting the claim that "Most jobs are created by small businesses and start up companies." The claim is made that lowering the top income tax bracket will encourage job growth, despite no evidence that I've ever seen that this claim is true. Nonetheless, platitudes like this are palmed off as "fact" constantly, and grievously the voters come to believe them.

No, if we use the tax system as an example, most legislation is considered a special-interest battle ground rather than a rational way to influence what government does. Rather than doing something simple that would be well understood by Congress, corporations and the voters, like a flat income tax or a progressive income tax without massive loopholes, we get our current tax code. Said another way, the complexity of the massive pile of loopholes and special deals that our tax code represents belies any possibly position that it "influences" the behavour of those being taxed in any way that even remotely related to the over arching goals for which it was created.

Therefore, my conclusion is that we should radically simplify the influences we apply to our complex and misunderstood system. I believe this because I think we've demonstrated that we simply do not know what we're doing. Indeed, I'd argue that we actually can't know what we're doing because of the level of complexity and the few accurate measurement inputs we have upon which to make the decisions.

To be specific, I believe we should set down a small set of simple goals. Given the current discussions "universal medical care" might be a good example. As I've said before, we actually do provide universal medical care, we just lie to ourselves about doing it and as a result do it badly. By making the goal explicit and clear, we could then set up a reasonable and far more economic system to meet that goal. From my personal research and chats with the folks I know at McKinsey about this particular subject, I'd estimate that we could reduce or total medical spending by over 30% by simplifying our goal and the system that we use to provide it.

I won't go into "why" we don't do this, this post is long enough. But I do believe we have exactly the Government we deserve, we elected them.